~Under Project Akanksha, in association with CGF Samhita, the brand plans to impart skill-based training to 25,000+ commercial vehicle drivers in India over the next 3 years, in line with National Skill India Mission

New Delhi (India), May 14: Tata Motors Finance, a leading Non-Banking Financial Company, and India’s largest financier of Tata commercial vehicles, has always believed in empowering the driver community – one of the key pillars of India’s vast transport and logistics industry. The brand recently took yet another step in this endeavour with the launch of Project Akanksha – its flagship skilling program that aims to impart relevant skill-based trainings to over 25000 drivers across the country, by collaborating with Collective Good Foundation (CGF), Samhita. The project is designed as a holistic and comprehensive upliftment program that covers critical aspects like financial literacy, entrepreneurship, occupation-related skills as well as life skills. The project involves conducting a comprehensive multi-city upliftment and cash flow maintenance program for safeguarding the financial future of the drivers. The program is a combination of academic and practical sessions to help the drivers gain relevant expertise.

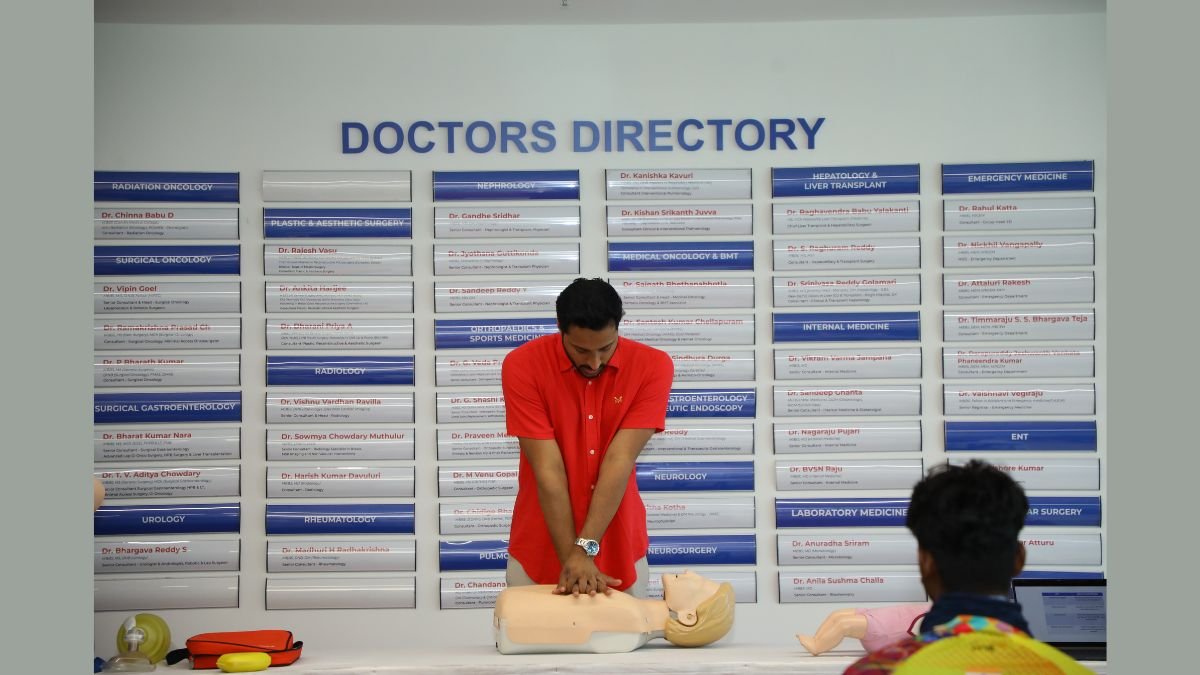

The Indian Commercial Vehicle industry is anticipated to grow at a CAGR of 18%, to reach 11,80,000 units by FY2025. With consumer demand bouncing back to pre-pandemic levels, a host of infrastructure projects lined up especially in Tier2 & Tier 3 cities, coupled with a massive government spending on capex projects, the demand for commercial vehicles is expected to surge in the next 2-3 years. Through ‘Project Akanksha’, Tata Motors Finance aims to equip the driver community with the requisite arsenal to leverage the upcoming opportunities. The focus is to ensure high impact by not only increasing the scale of training year-on-year, but also enhancing the quality of trainings in order to ensure that the drivers are not just prepared but are more than ready to thrive in any environment. So far trainings have been carried out in 15 cities viz Ambala, Anuppur, Bhojpur, Guwahati, Gwalior, Hyderabad, Lakhimpur, Lucknow, Mumbai, Muzaffarpur, Nammakkal, Patna, Pune, Vizag and Vijayawada, covering over 8000 drivers.

Punit Puri, Chief Human Resources Officer, Tata Motors Finance shared, “Thanks to the rapidly expanding road network and fast pace of highway construction, along with a booming e-commerce sector, the Indian Commercial Vehicle Market is all set to witness a massive bull-run in the next few years. Increasing urbanization and growth of SMEs are further substantiating the rise of Indian CV industry and we want to ensure that the driver community is able to make the most of the opportunities ahead. As per ASDC and EY’s recent report, there are numerous skills required by drivers like basic mechanics, financial management, vehicle detailing, transport management, etc., as a complementary skill to driving. The report also highlights that road transport segment would require an incremental human resource of 26.36 million to meet its requirements by 2026. On the occasion of International Professional Drivers Day, we are happy to share that Tata Motors Finance has pledged to train 25,000 Indian drivers under ‘Project Akanksha’ in the next 3 years, bridging the financial literacy and skill gap in the driver community, carrying forward the National Skill India Mission.”

“The Indian commercial vehicle driver community is severely underserved and vulnerable to safety issues. Equipping them with skills that can help them build sustainable enterprises is a high priority in our country. By focusing on crucial aspects of their lives – professional, health and financial, we are confident that we can change their attitude and practices with regard to their profession, peers and the industry at large. This partnership will immensely benefit the driver community, empower them through the acquisition of relevant skills and potentially lead to entrepreneurship or community enterprise.” Priya Naik, Co-Founder, Samhita.

Project Akanksha aims to enhance knowledge, address growth barriers and strengthen the driver community through the following focus areas

- Financial Literacy: Sensitize and train them on developing financial acumen and discipline

- Entrepreneurial skills

- Soft Skills for Business and enhancing Employability

- Digital Literacy: Enable them to track and manage their expenses through digital tools.

- Occupation related: Road safety, Substance abuse, Health & Wellness.

Established in 1957, Tata Motors Finance is a Non-Banking Financial Company and one of the pioneers in the vehicle financing industry. Headquartered in Thane (Maharashtra), the brand has a strong footprint across India and operates through its own 250+ branch networks and 700+ channel partners in addition to Tata Motors dealers’ sales outlets. Currently, the brand is servicing over 17000+ pin codes across the country and touched over 2 million customers since its inception. Its portfolio includes loans for new and used vehicles, vehicle and customer lifecycle products like refinancing, working capital, fuel loans, tyre loans, fastag, insurance and many more, along with loans to vendors and suppliers of Tata Motors, all to benefit Tata Motors and its strategic partners.